Save Your Home: Understanding All Your Options

Save Your Home: Understanding All Your Options

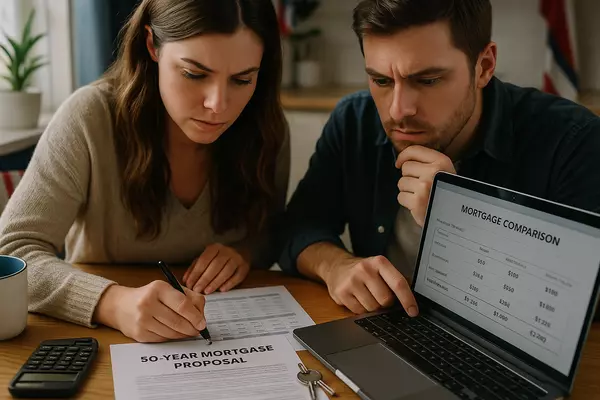

Feeling like you’re standing in the middle of a storm? You’re not alone. In early 2025, roughly 1 in every 3,612 housing units in Florida had a foreclosure filing. And in the first half of the year, Florida logged over 15,000 foreclosure starts, among the highest in the nation.

These numbers might feel overwhelming—but they also make one thing clear: help is available, and acting early makes a difference. My goal is to walk you through the key options so you can see the full landscape, feel empowered, and decide what’s best for you.

1) Recognize Where You Are

The first step is understanding your situation. Many homeowners assume once a payment is missed there’s no hope—but that’s not the case. Most journeys begin with:

-

Missed or late mortgage payments

-

Letters from your lender about default

-

Rising cost burdens (taxes, insurance, HOAs)

-

Loss of income or unexpected expenses

Florida homeowners are feeling this especially hard—annual “hidden” homeownership costs have climbed dramatically, which squeezes budgets and accelerates stress. If you’re seeing these signs, pause and plan. Time is your ally.

2) Know Your Options

Here are the major paths to explore. Each has pros, cons, and eligibility criteria.

A) Loss Mitigation (Modify, Forbear, Refinance)

-

Loan modification: Adjust interest rate, term, and/or payment to restore affordability.

-

Forbearance: Temporary reduction or pause in payments during a verified hardship.

-

Refinance / Repayment plan: Replace your loan or structure catch-up payments over time.

B) Short Sale (Pre-Foreclosure Sale)

If keeping the home isn’t realistic, a short sale (selling for less than what’s owed with lender approval) can help you exit with dignity and often rebuild faster than a foreclosure.

C) Deed in Lieu of Foreclosure

A last-resort option where you voluntarily transfer the deed to the lender. Credit impact is still serious—but generally less damaging than a completed foreclosure.

D) Stay and Catch Up

If you have equity and a path forward (downsizing, lifestyle adjustments, or selling strategically), act proactively rather than reactively. That’s often the strongest position.

3) Why Acting Early Matters

Foreclosure activity ticked higher year-over-year in early 2025, and Florida consistently ranks near the top for filings. Once the process moves toward auction or bank-owned status, your choices shrink.

Bottom line: the earlier you engage, the more options you retain. Whether you modify, sell, or reposition, doing something beats doing nothing—every time.

4) What I Bring to the Table

With 15+ years in South Florida real estate and deep experience in complex situations, I help homeowners:

-

Navigate paperwork, timelines, and lender requests

-

Compare paths (modification, sale, refinance, creative solutions)

-

Connect with trusted pros (legal, tax, counseling)

-

Protect equity and future options

Clients value the clarity and calm I bring. If you’re reading this, you’ve already taken the first step—learning. Let’s keep going.

5) Helpful Next Steps (Free Resources)

Choose one action you can take today:

-

✅ Download my quick checklist: 15 Do’s & Don’ts for Homeowners Facing Financial Hardship – avoid common (costly) mistakes.

-

✅ Get the full guide: Save Your Home – Free eBook – real strategies banks don’t tell you (loan mods, creative partnerships, community programs).

-

✅ Track your equity automatically: Free Home Equity Report – see your value, loan balance & equity growth.

(Coming soon: Equity Protection Worksheet and Loan Modification Prep Checklist—these will be linked here when live.)

6) Let’s Talk

You don’t have to navigate this alone. If you’d rather talk one-on-one, schedule a complimentary, confidential consult. We’ll review your situation—no pressure, no judgment—and map out the path that fits your goals.

Erica Batista, Realtor® | Area Leader – Allure at LPT Realty

📞 (561) 633-0707

✉️ info@MyRealtorErica.com

🌐 www.MyRealtorErica.com

📅 Book a Consultation

Your home is more than an address—it’s stability, memories, and your future. Let’s protect that—together.

Footnotes

-

ATTOM – Foreclosure rates (early 2025).

-

PR Newswire – Florida foreclosure starts, H1 2025.

-

Axios – Annual “hidden” homeownership costs for Florida homeowners.

-

Live South Florida Realty, Inc. – YoY change in foreclosure starts (early 2025).

-

FOX 4 News Fort Myers (WFTX) – Florida’s ranking among states for foreclosure filings.

Categories

Recent Posts

With over 15 years of local market expertise, Erica helps Palm Beach County homeowners and investors navigate complex real estate decisions with clarity, strategy, and confidence.

GET MORE INFORMATION